ZT20 #007: The SaaS Startup Growth Framework

Jun 10, 2023B2B SaaS founders are smart, they understand at some point even they are going to have to cross the chasm from product-led growth to sales-led growth, whether they like it or not.

Even seemingly 100% product-led growth companies, have significant sales orgs. Salespeople represent about 30% of the employees at Slack and Dropbox, and about 45% of employees at Zoom and Datadog (Source: LinkedIn, 2021).

My job as an early-stage CRO for the past 15 years, and most recently in my consulting practice as a fractional co-founder/revenue leader with a GTM lense, has been to demystify growing revenue in early-stage B2B SaaS startups, and working in tandem with founders to deliver sustainable growth that maximises revenue, and minimises dilution.

Over the coming months, I’m going to break down the general framework I began to develop informally as an operator, and now deploy formally as a consultant for some of the world's fastest-growing early-stage B2B SaaS companies.

Today’s newsletter is the introduction, an overview of why breaking down startup growth into pragmatic and somewhat chronological chunks makes sense for every founder, investor and executive.

All upcoming newsletters for the foreseeable future will dive deeper into every one of the phases and stages of growth.

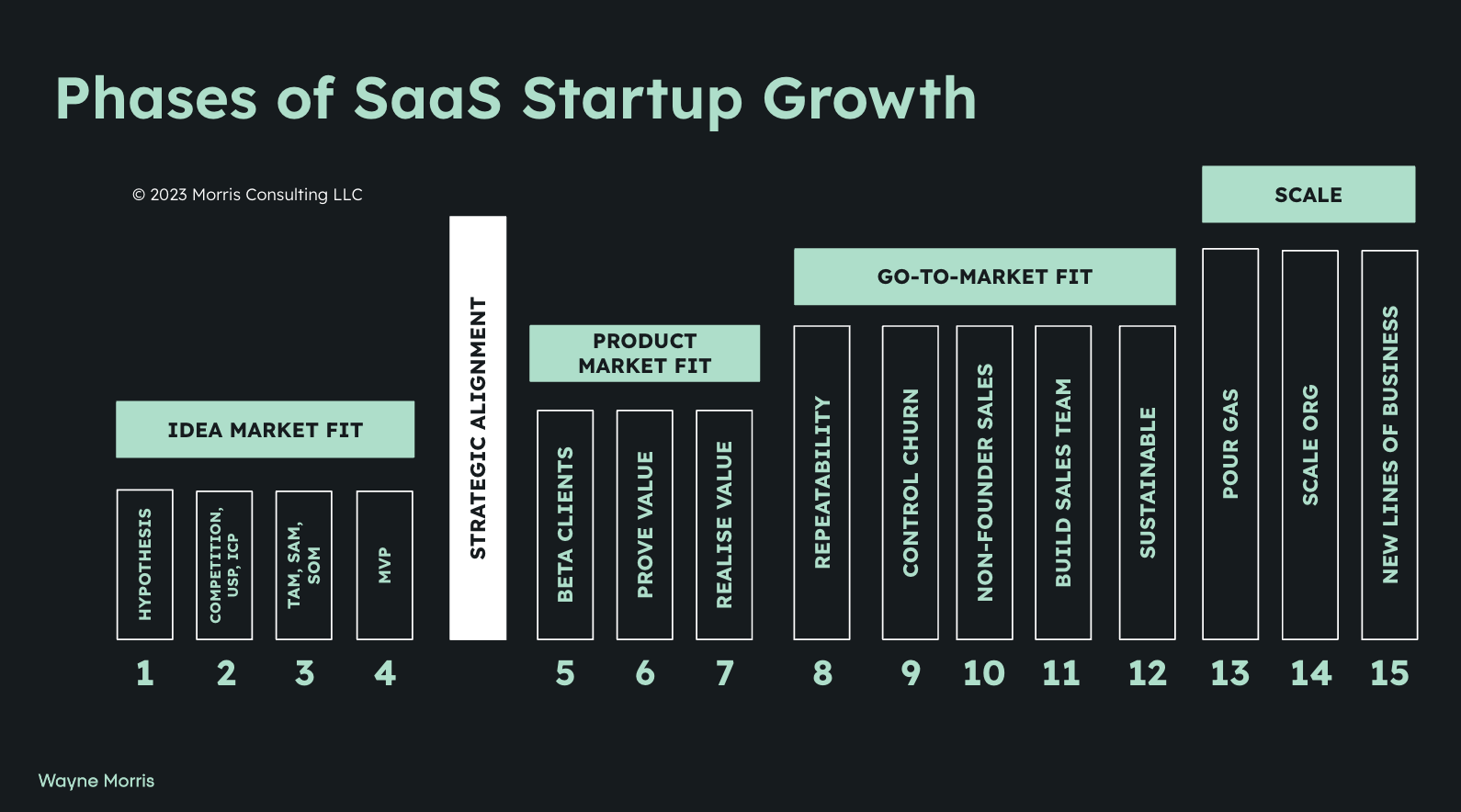

Fig 1: Phases of Startup Growth by Wayne Morris Consulting.

The goal of my framework

In my experience, in early stage B2B SaaS, there are distinct stages of growth. We can argue about the nomenclature, and the definition of each pillar that make up the stages as well as the exit criteria for each (and whether you ever actually ever “exit” any of these stages!) until the cows come home, however, my continuum is a reflection of what I’ve personally experienced during my 20+ years in this game.

Side note: I challenge the efficacy of this framework almost daily in my interactions with the market. For example, since my last newsletter, I formalised “idea market fit” into my framework as the primary stage because I observed many founders needed to go back to base in order to realise their potential. More on this in the next newsletter.

My intention with this framework has always been to achieve the following:

1. Optimal capital deployment:

There are stages of growth with definitions and exit criteria that founders should appreciate, in order to wisely deploy the right amount of capital at the optimal time. Founders routinely give away their dreams to others (chiefly VCs) far too prematurely in my opinion.

This framework alone stops many founders in their tracks and has them reflecting on where they are at on their evolution curve but more to the point, it immediately has them questioning whether their burn rate is optimal or otherwise.

2. Alignment with me:

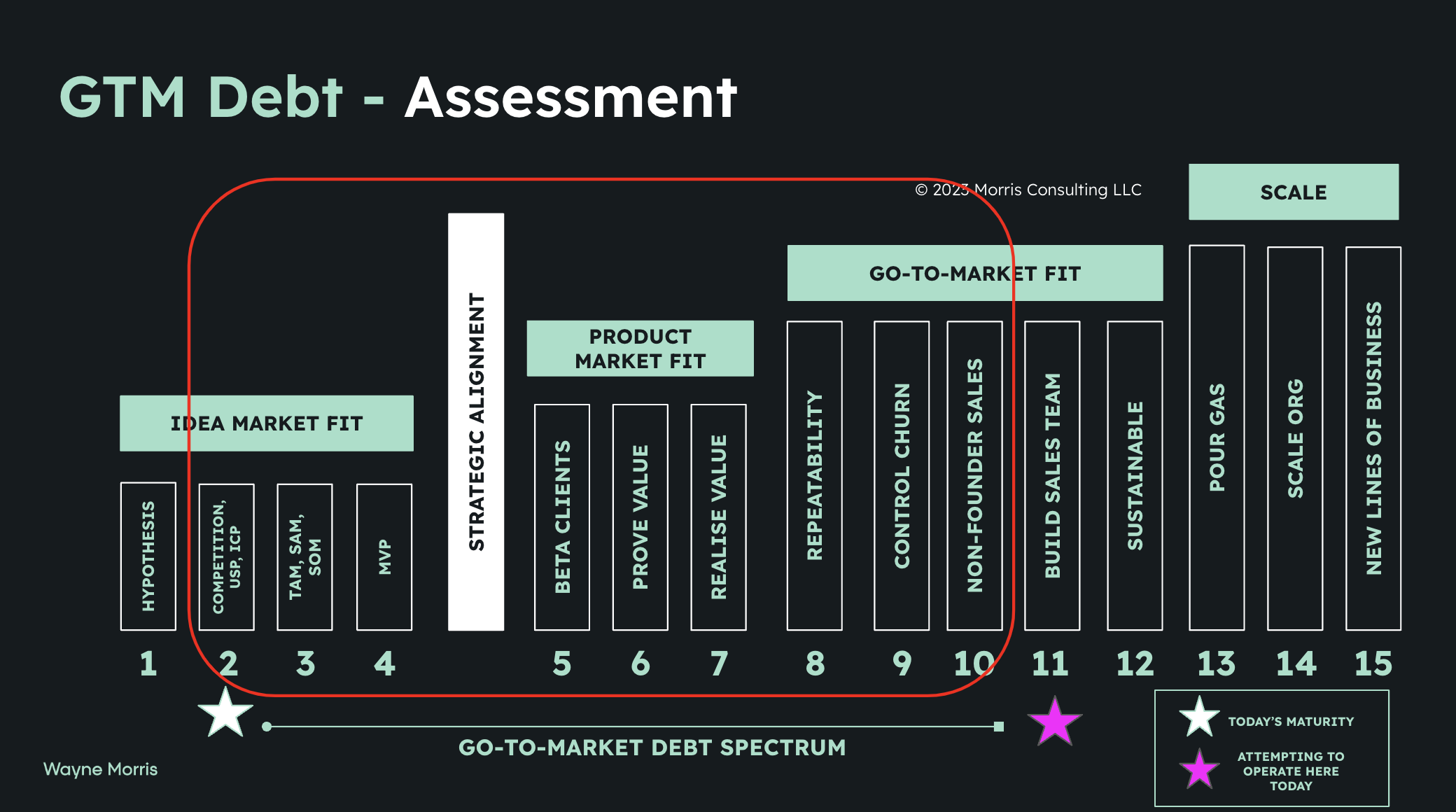

Where founders are trying to operate and where they are actually at from a GTM maturity perspective is often worlds apart (see Fig 2. below). That gap is what I call define as “go-to-market debt”. This graphic is used in my assessments to illustrate that debt and subsequently align around what founders need to do to pay it down.

Scaling a business laden with GTM debt is a fool's errand. And yet by my estimation, 90%+ of SaaS companies are attempting just that!

Making the assessment of GTM debt is a 4-8 week exercise and something I refer to as my Scale Audit. It assesses in detail the maturity of the org, starting with a series of 98 questions, broken down into 5 key areas of the business:

- Operational Efficiency

- Market Positioning

- Product

- Organisational Alignment

- Go-to-market Process

Often the resultant gap is large, which is both alarming and scary for the founder. The founder needs a co-pilot to help navigate the path of paying down that GTM debt. And of course, ideally, that co-pilot is someone who has experience of successfully building early-stage B2B SaaS, on a realistic budget.

Fig 2: Go-to-market maturity assessment

3. Alignment with the team:

The early-stage team can often feel the strain and pressure of operating at a level far beyond where they are enabled. Selling a half-baked product, into a half-baked market opportunity, creates a ton of false dawns, and of course, no-one hits goal.

However, offering the team a transparent maturity framework and agreeing with them where they are actually at in terms of GTM maturity and where they would like to get to, with available resources and in what timeframe, releases a ton of pressure from the room, and instantly has resources pulling in the same direction.

The outcome of the team being aligned around what is realistically achievable is increased productivity, increased morale, better hiring, lower staff churn and therefore a greater likelihood of success.

4. Common language

Beneath the framework is a common language that includes terms such as “exit criteria” with data and insights, and “anti-patterns”. This creation of a common language and common set of definitions in turn establishes a set of harnesses that ensures no one ventures too far off the reservation without good justification - including the founder.

The outcome:

Much of this comes down to the willingness of the founder, to be honest with themselves, with their investors and with their team - often easier said than done in the maelstrom of the early-stage SaaS ecosystem.

Then it comes down to the founder's willingness to both do the work and play the long game.

This framework is the backbone of every interaction I have with founders, from the moment I meet them, to the moment they have de-risked their startup enough to hire a VP of Revenue/CRO.

This result is alignment from the board down to the individual contributor, the bi-product of which is venture-level ARR growth, which is both sustainable and repeatable.

The bottom line for founders and execs is this: Be honest about your stage of growth and put together a realistic plan to achieve ARR growth that is both sustainable and repeatable in order to maximise growth velocity and minimise dilution simultaneously.

Thanks for reading folks, you’ve got this! 👊🏼

Wayne.

#saas #sales #startups #venturecapital #GTMdebt

Need help scaling recurring revenue? Here's how I can help:

Executive co-pilot: If you're a CEO/Founder of a B2B SaaS Startup and this content resonates and you want hands-on help in your B2B SaaS startup, consider working with me directly in your business:

Step 1: Book a Strategy Call - A high-level assessment of your GTM debt.

Step 2: Scale Audit - A deep dive into the actions and priorities to get you to scale

Step 3: Executive co-pilot - Me and my team will guide you from your stage of growth to scale, de-risking your B2B SaaS startup.

Start HERE, by booking your strategy call.

Free reading: Subscribe to my channels for free insights on how to evolve from founder-led sales successfully and build a world-class go-to-market organisation.

→→ Newsletter - Join over 1,000 Founders, CROs and VPs of Sales and receive insights from my 20+ year career in fast-growth enterprise B2B SaaS startups.

→→ LinkedIn - Follow me on LinkedIn for my takes on fast-growth enterprise B2B SaaS startups

→→ Twitter - Follow me on Twitter for my takes on fast-growth enterprise B2B SaaS startups