ZT20 #012: The GTM Hierarchy of Needs

Nov 04, 2023When founders set revenue targets, or project growth to excitable future investors, they frequently misunderstand the complexity of the connective tissues that form the foundation and pathways that are essential to deliver fast growth in a sustainable and efficient manner.

The result is unnecessary equity dilution, terrible sales cultures, and mass burnout across the go-to-market org.

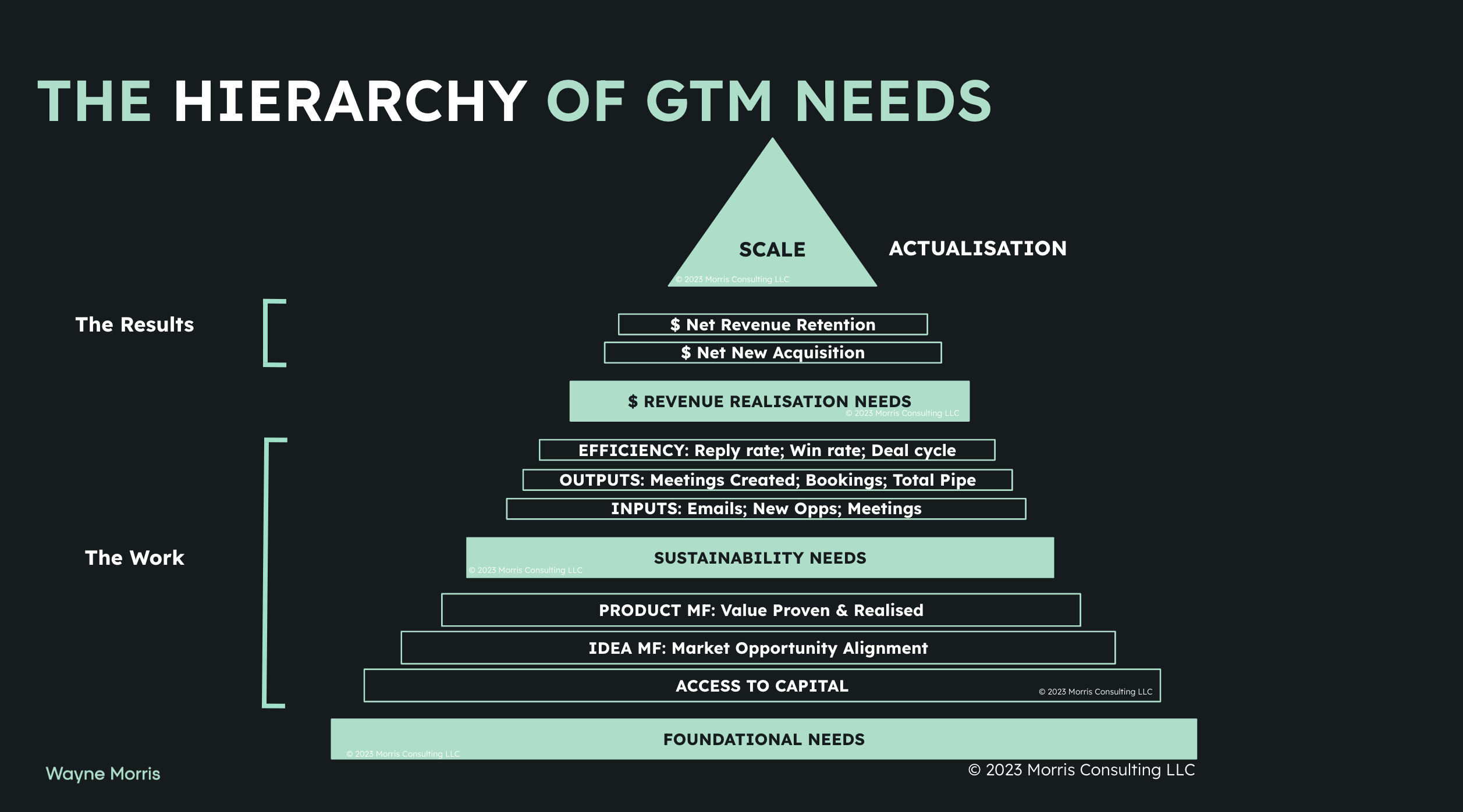

To illustrate these complexities I refer my founders and the venture community to something I call the Hierarchy of Go-To-Market Needs:

Fig 1: The Hierarchy of GTM Needs

The hierarchy (hat tip: Abraham Maslow) illustrates the chronological dependencies of scale, the holy grail for every founder and investor in SaaS, and forms a platform for discussing what it will take to get there.

Let’s break it down.

Liking what you read so far? Want a deeper dive?

Foundational Needs:

At the foundational level, you must have access to some form of capital to fund this effort in the first place.

The most common anti-pattern in SaaS is a founder believing that raising capital validates their business and is the starting gun for spending capital to grow aggressively. Wild right? But oh so common!

The founder needs to have reached two major milestones before they can confidently spend increased sums on growing revenue.

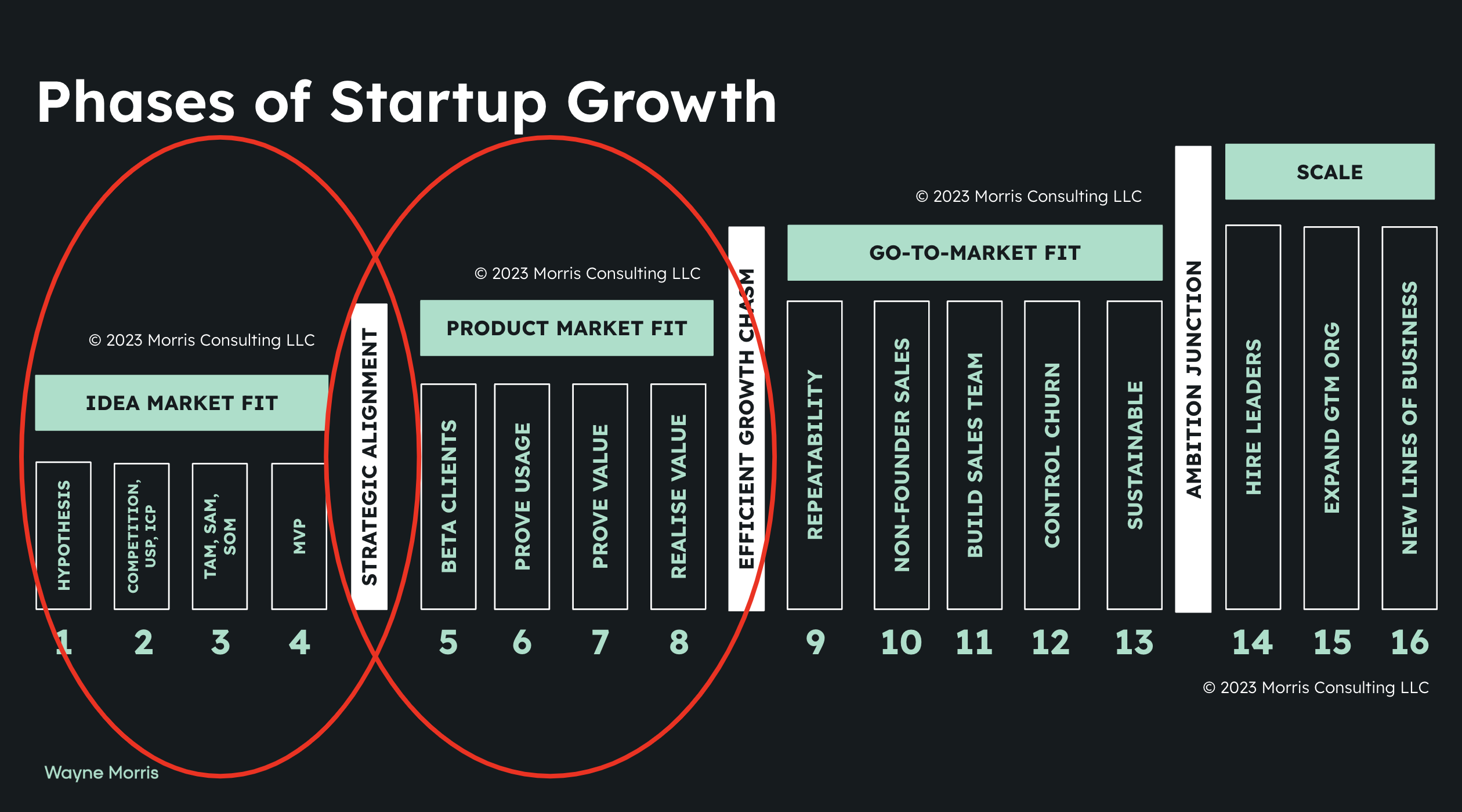

The first I call Idea Market Fit, and the second is Product Market Fit:

Idea Market Fit:

Fig 2: Idea Market Fit & Product Market Fit as part of the Phases of Startup Growth Continuum

The goal of the idea market fit phase is to create internal strategic alignment around the problem the team is trying to solve, the competitive landscape, the market opportunity and the product required to get early-stage traction.

The piece that is most commonly overlooked here is the competitive analysis that leads to a well-thought-out ideal customer profile (ICP) hypothesis.

The most common anti-pattern here is a founder speaking to 50 “friendlies” (people in their network or their friends’ networks) and creating an ICP hypothesis without validating those discussions with market research.

Failure to truly appreciate who the incumbent direct and indirect competitors are leads to inaccurate assumptions of uniqueness and value which translates to poor targeting of prospective companies and personas within those firms.

Product Market Fit:

The goal of the product market fit phase is to prove and realise the value of your product and solution within your hypothesized ICP.

It never ceases to amaze me that so many capital allocators fail to do real due diligence here.

These are the primary pillars of Product Market Fit (PMF) in my definition of enterprise B2B SaaS:

- Acquire beta clients - self-explanatory, however, for those at the back, they MUST be ICP, friendly or otherwise, they MUST be ICP.

- Prove usage - yeah that’s right, your product or service has to be use in order to have a shot at product market fit. I can cite at least 2 companies I turned up to that had each raised >$40M and there was little to no evidence that the clients were actually using their product.

- Prove value - the bedrock of PMF is the exchange of tangible value. This should not be a controversial point, sure it may be hard to quantify the value but rarely is it impossible. Can’t prove value? Good luck retaining that revenue.

- Realise value - the validation of PMF is when the value exchanged is fairly recompensed, in my experience 10-20% of the exchanged value is a good marker.

Once these foundations have been built and tested, they will need iterating before leaning into them. Another common failing.

What comes next are sustainability needs.

Liking what you read so far? Want a deeper dive?

Sustainability Needs:

Controlling the sustainability of go-to-market must be baked into the DNA of the business, which essentially means the codebase of the sales org has to prove it can operate scientifically.

What does this mean in reality?

Well, beyond the obvious operational aspects of growing revenue, which includes evolving from founder-led selling, building your first sales org by committing to role specialisation, and managing post-sale revenues and relationships proactively, what it practically means is managing by numbers.

Does every $1 you input, result in more than $1 as output? And do we have an understanding and control of what happening in between?

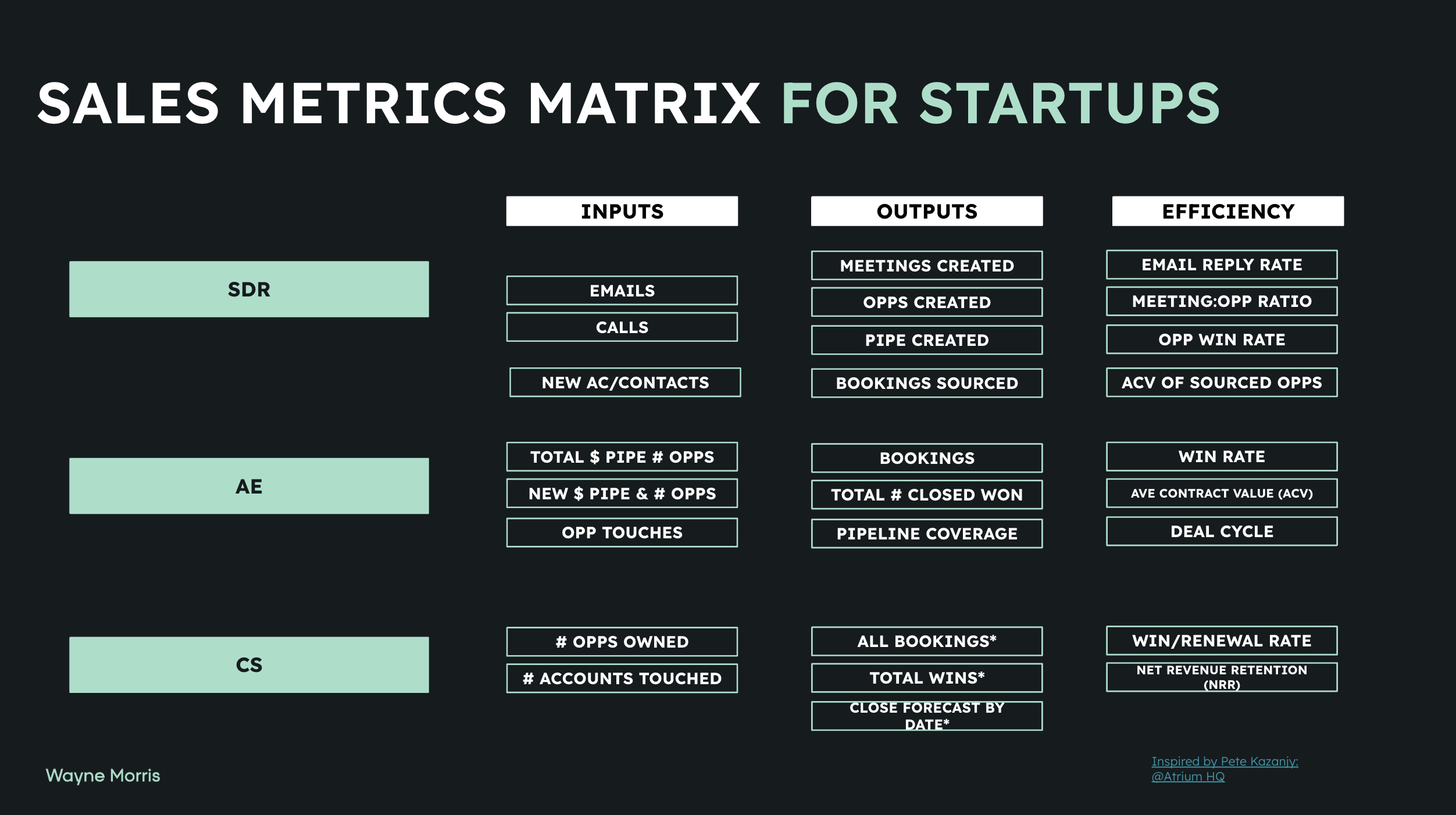

Every SDR, AE and CS person needs to be closely managed to inputs, outputs and we must measure efficiency to be sure the business can sustain itself. These measures are the levers of success GTM success.

I like the way Pete Kazanjy and the team at AtriumHQ think about metrics by role in the sales org. Here’s an adapted (simplified) version of what they put out in some of their materials that I like to start with.

Fig 3: Sales Metrics Matrix for Startups

Fig 3: Sales Metrics Matrix for Startups

The most common anti-pattern here is failing to measure the repeatability and efficiency of the motions that have driven the top-line revenue. Startups are a scientific experiment, yup, even the sales part. You have to measure almost everything, to iterate optimally.

Revenue Realisation Needs:

If all of the above is in order, healthy net new, renewal and upsell revenue flows. And when it hits a speed bump, you have a set of artefacts to guide your adjustment of the levers to get you back on track.

The common anti-patterns here relate to having limited control over that top-line revenue. Simple examples are:

a) Opportunity origination: Not knowing where your revenue originates from. Is it organic via the website, is it inbound via marketing activities, or is it outbound or a combination of everything?

b) Top performers: Not knowing who your top performers are by discipline and therefore failing to effectively manage the team, by numbers vs gut feel/what you ‘see’.

c) Masking churn: Top-line revenue growth looks good, until you scratch beneath the surface and realise net new is masking churn. That’s like living life on a credit card. Happens all of the time. Hard landing incoming.

Scale Actualisation:

Whilst it’s a constant game of iteration, if the foundations are sound, and the business is sustainable, true scale can follow if the data you gathered in the idea market fit phase about the size total addressable market remains true.

Sure, there’s a lot of nuance, however if you understand and stay true to the GTM hierarchy of needs, you have a shot at actualising scale.

Thanks for reading.

Wayne

Strategy call: If this resonates you’d like to have a strategy call, please find time here

Testimonial: If you LOVED this newsletter, I’d be eternally grateful if you recorded a video testimonial here, it will help keep me writing, and help keep it free 🙏🏼

Peace & Love to you all ✌🏼💙

#sales #saas #startups #venturecapital #GTMdebt